Greene County Personal Property Tax

Class opening requirements. Damage and item formulas. Final fantasy tactics calculator. HP, MP, PA, MA, Speed, growth, and multipliers.

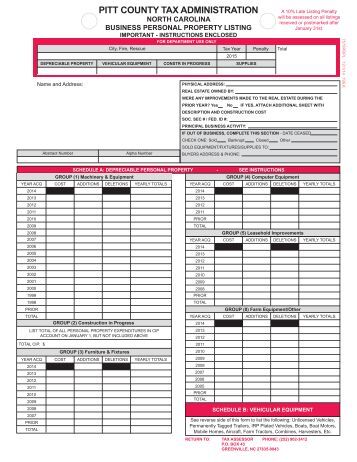

Beautiful Stock Of Greene County Personal Property Tax Receipt Image Source by stervantes.club – Through the thousands of photographs on the net about greene county personal property tax receipt, we picks the best choices along with best image resolution only for you, and this images is considered one of pictures choices in our best pictures gallery concerning Beautiful Stock Of Greene County Personal Property Tax Receipt. I am hoping you’ll enjoy it.This specific picture (Greene County Personal Property Tax Receipt Lovely Personal Receipts Personal Receipts Clay County Mo Personal Property) over can be labelled along with: greene county assessor personal property tax receipt,greene county missouri personal property tax receipt online,greene county mo assessor personal property tax receipt,greene county personal property tax receipt missouri,print personal property tax receipt greene county missouri,submitted by three with 2018-04-05 04:26:26. To see many images inside Beautiful Stock Of Greene County Personal Property Tax Receipt pictures gallery make sure you follow this kind of web page link.The Amazing and Stunning greene county personal property tax receipt with regard to Motivate Your property Existing Home Comfortable FantasyHome.

Greene County Personal Property Tax Payment

4.jpg)

Property Taxes and Tax Receipts Tweet Property values are assessed and paid locally; therefore, you will need to contact your local county collector and/or assessor regarding changes of address, payment and billing, tax receipts, and all other questions regarding your account. Cathy (CJ) Hays, Tax CollectorAbout this site Technical Support. The total amount will be adjusted to allow for the electronic processing of the transaction through the state's eGovernment service provider, Arkansas.gov. Greene County does not receive any portion of these fees. Taxes paid online will be credited to your account within 48 hours.

Greene County Personal Property Tax Springfield Mo

About Assessor and Property Tax Records in MissouriMissouri real and personal property tax records are managed by the County Assessor or County Collector in each county. Land and land improvements are considered real property while mobile property is classified as personal property.A few County Assessor and County Collector offices provide an online searchable database, where searches can be performed by owner name, parcel number, address, or by using an interactive map. Search results can include tax records as well as appraisal records. Depending on the county, registration may be required to access property tax records.For counties that are not online, requests must be made in person, by phone, or via written request.Adair County.